The 3+1 ICP

Always bring a +1.

tl;dr - ICPs only work if you can act on them systematically:

The 3+1 ICP framework simplifies ideal customer profiles into three universal dimensions—size, geography, and industry—and one or more unique "+1" factor(s) specific to your business.

Operationalizing the "+1" is critical but hard; it can get so specific that it’s impossible to use at scale. This is inefficient because reps waste time manually discovering fit.

To make the "+1" actionable, identify a proxy to qualify or disqualify accounts at scale before they ever get assigned to reps.

Read on for the whole story.

Most B2B companies—even mature ones—struggle to define and operationalize their ideal customer profile (ICP)1. If you find yourself arguing about ICP yet again as we head into the next fiscal year, you’re not alone.

I’ve seen a clear pattern in my conversations about ICP with revenue leaders: the 3+1 ICP. It’s a useful framework for any org trying to update their ICP or just get it to work better in practice.

Every B2B company has the same 3 core ICP dimensions: size, geography and industry. They’re easy to acquire, have common definitions and are easy to operationalize.

Then every company adds 1 (or more) additional factors that are unique to their business. These are are often uncommon, possibly even unknowable or extremely subjective. Naturally, they’re also very difficult to operationalize.

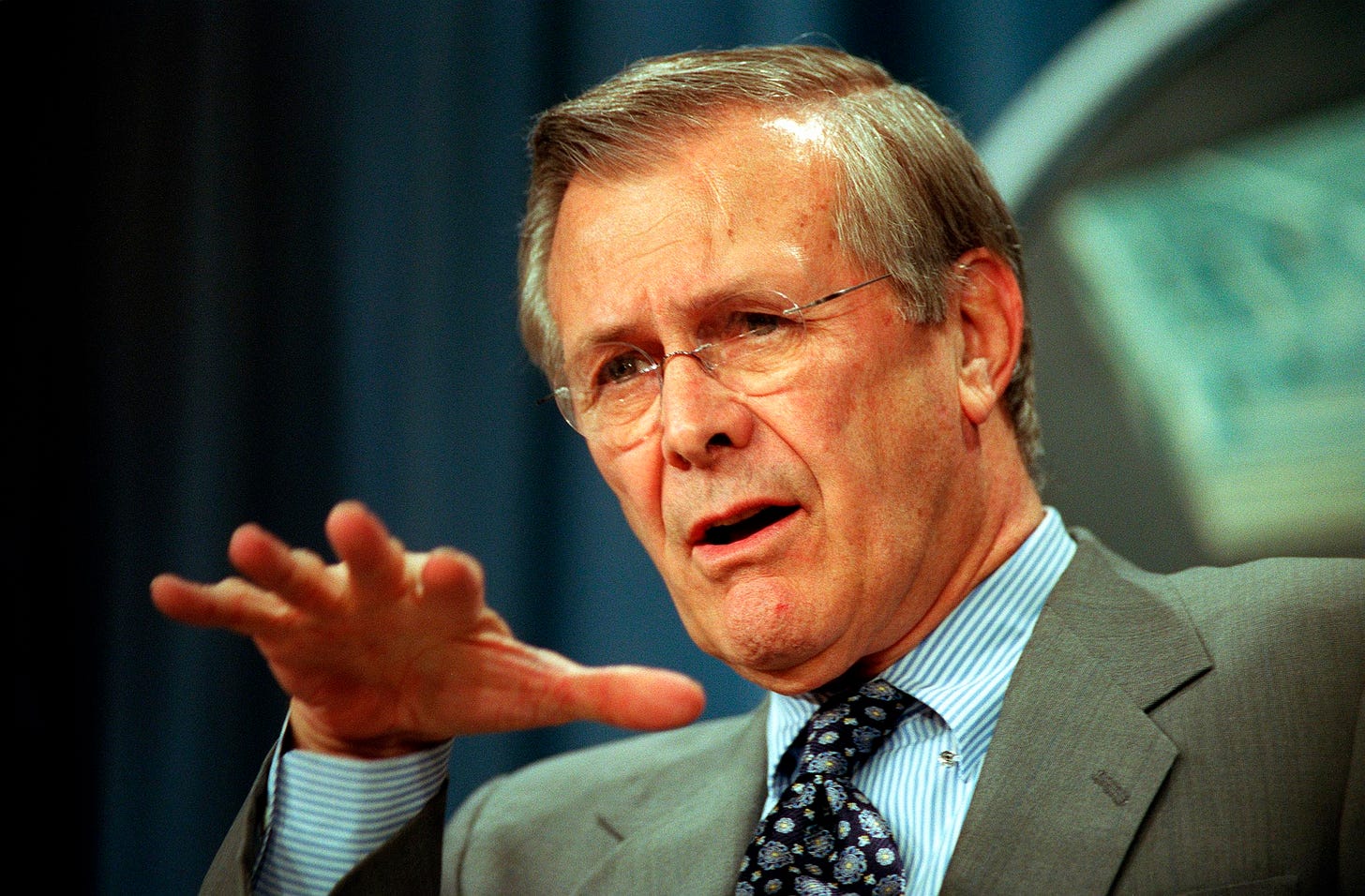

There are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don't know we don't know.

— Donald Rumsfeld, Former Secretary of Defense

Because the +1 is so difficult to use at scale, it’s often more aspirational than actionable. We don’t use it in segmentation or territory design—instead we tell the reps they need to learn it during discovery. This has all sorts of ramifications, but the worst is a massive waste of rep energy on accounts that turn out to be a poor fit.

Let’s discuss how to avoid this trap and turn the +1 into something concrete. But first, let’s take a quick tour through what the big 3 are trying to tell us.

The ICP big 3

Nearly every B2B company has an ICP with the same 3 core dimensions: size, geography and industry. These aren’t just data points—each of these dimensions is really a proxy for something that actually impacts prospect fit and/or how we need to run a sales cycle.

👥 Size

This is a proxy for buying power or complexity. It’s usually expressed as employee count or revenue. Segmentation usually start by bucketing companies by size. While one might think these segments would be standardized2, everyone mostly just comes up with their own bespoke definition of SMB, mid-market, enterprise, etc.

🌎 Geography

This is a proxy for laws, language, timezones and culture. This comes down to whether we’ve got the capacity to serve someone in a particular geographic area.3 “Capacity” in this case might be defined by product capabilities (e.g. localization, legal compliance) or service capabilities (e.g. reps with the right language skills)4.

🏭 Industry

This is a proxy for groups of companies that do similar things. It’s usually expressed as some top-down classification like NAICS or SIC5. The goal, of course, is to find industries where your offering is more compelling.

Put all these together and they represent the first cut of your SOM (aka Serviceable Obtainable Market, aka a small fraction of the TAM you used in your last pitch deck).

Each of these is easy to buy off the shelf from any old data provider. But they’re not good enough on their own. A truly good ICP has to go further. That’s where the +1 comes in.

The +1 (aka The Missing Piece)

The +1 is the ICP attribute (or attributes) unique to your business. Here are real examples I’ve heard recently: has a travel search use case, does SMB payroll, offers pharmacy services, visits consumer homes, depends on performance marketing, has resort properties, and is a well-established full-service restaurant.

These factors narrow down the SOM (companies we are capable of selling to) to an ICP (companies who truly need what we offer). The CEO, finance, sales, marketing and even the board will weigh in here—it’s that important. Everyone has to be aligned on the +1 (or +1s).

The +1 is critical. However, it often goes wrong.

During this alignment process someone will inevitably speak up and wisely intone, “We must get even more specific! Overall performance marketing spend is important, but we also know our win rates are 2% higher with companies6 that spend more than $2,000 on paid Bing search on Tuesday afternoons.” Everyone agrees that this is indeed wise and then it becomes baked into the ICP as a +1.

The RevOps team is then tasked with identifying prospects that fit the ICP. However, because they’re so used to thinking about the world in terms of “data points” they can buy off the shelf, they’re usually looking for some dataset that gives them precisely the number they’re looking for.

No such dataset exists, so they’re left with only one option. RevOps can’t remove this +1 from the ICP, after all everyone agreed it was important. Instead RevOps segments and scores the accounts using the three core dimensions and then assigns those accounts out to reps. Then they add a CRM field called “Bing Spend on Tuesday Afternoons” and make it required for reps to create an opportunity. Problem solved.

This is how a well-intentioned ICP becomes aspirational, not actionable. We just transfer the work to the reps without truly operationalizing it.

How to operationalize a +1

Operationalizing the +1 is the difference between an ICP definition making a huge difference or being a waste of time. If you can describe it in words but can’t help your sellers actually target companies that fit the +1, you haven’t really changed anything.

Clearly the +1 example above is unknowable at scale. If you’re doing any kind of commercial sales where there’s more than a few prospects, you’ll waste tons of rep energy talking to the wrong companies before eventually disqualifying them.

That doesn’t mean you should give up on a precise +1. Even though the example is facetious, these unique attributes are why ICPs matter—they drive focus.

Instead, make the +1 usable by finding a proxy that can help you eliminate accounts that aren’t a good fit before a seller ever spends time on them. Try using an approach like the 5 Why’s to drill down into what it is about the +1 that actually makes the prospect a good fit for your offering.

For example, let’s say a company that sells an AI landing page service has defined the above “Bing search spend on Tuesday” +1 attribute. Here’s how they might drill down to a +1 they can actually apply:

Q: “What does Bing search spend on Tuesday tell us about the company?”

A: “That means they value paid traffic to landing pages and that’s what we help with”

Q: “Why would they value paid traffic?”

A: “They probably get most of their customers from paid spend”

Q: “Why’s that?”

A: “They sell to consumers and that’s the best way to reach them”

The +1: “Let’s classify accounts based on whether they sell to consumers”

It’s not perfect, but it gives them a new way of pre-qualifying (or disqualifying) accounts without just throwing up their hands and telling the reps to go figure it out. Plus, it’s doable at scale now, especially with AI-based web scraping.

As you find yourself deep in your 2025 ICP debates, define the specific +1s that make your ICP meaningful. However, don’t treat operationalizing those attributes as an afterthought. Your reps—and your pipeline—will thank you.

Vertical SaaS does this very well.

Here’s what Gartner thinks. The US Small Business Administration has an even crazier table of definitions that define small businesses by NAICS code.

I didn’t say state or zip. Laws, language and timezones (to some extent) matter. Don’t slice finer than that.

Never try to sell the French something in English. And may god have mercy on your soul if you try that with French Canadians.

This is badly broken. NAICS and SIC were built for government economists, not sales. I recommend bottoms-up clustering like Market Map.

n=2