You Are Not AI Native

Notes from the Pavilion GTM 2025 conference.

Last week I was in DC attending Pavilion’s GTM conference at the lovely Mayflower Hotel, site of every Inaugural Ball from 1923 through 1981.1 If I’d known this fact while I was there I’d have tried to find some pictures—I’m thinking July 4th at The Overlook Hotel, but politics.

Forty-four years after that last Inaugural shindig, I found myself sitting in a basement ballroom listening to panels about GTM. Gaurav Agarwal, COO of ClickUp, posed a question to the audience, “How many of you have a pipeline problem?” I’d say 90% of the nearly full room raised their hands.

I talk to folks with pipeline problems every day, but even I was a little taken aback at the number of hands in the air.

I suppose it could be selection bias. Perhaps the people who come to Pavilion events are the ones seeking help with big GTM problems.2 Maybe, but I see it all the time outside Pavilion as well.

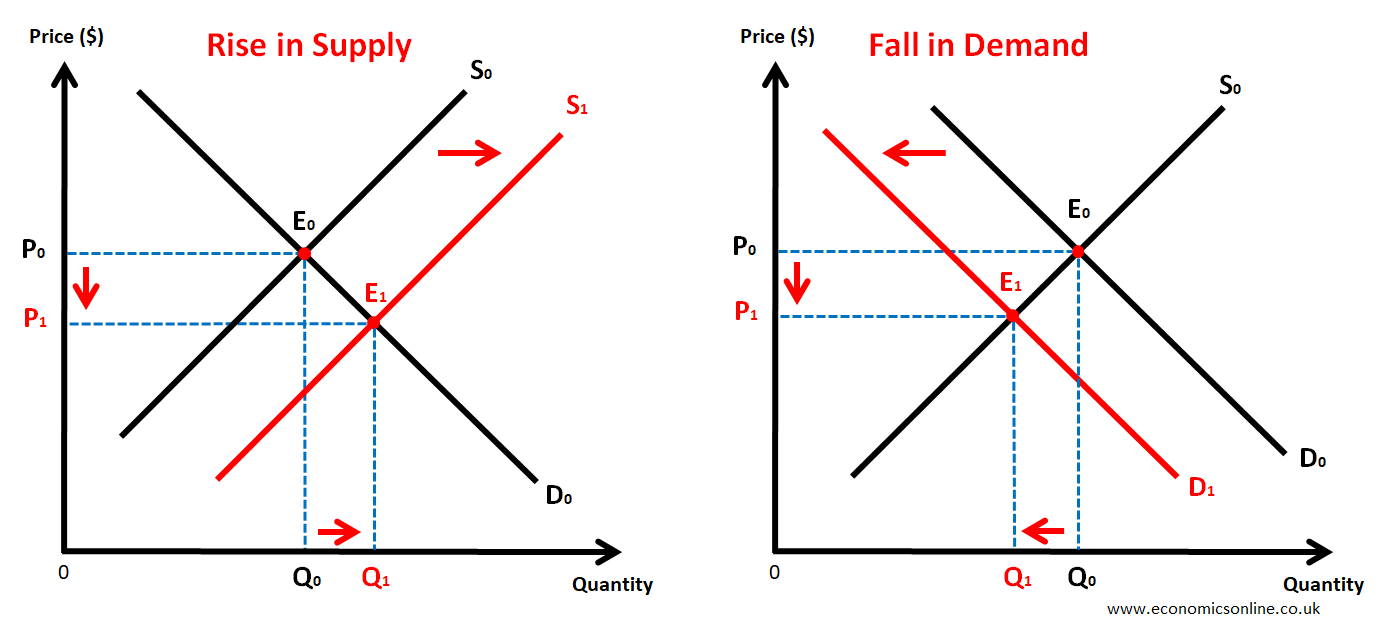

So are all these people just incompetent demand generators or is there a broader phenomenon at play? I’d argue that there’s a broader phenomenon. But it’s a problem of supply, not demand. Anyone remember these diagrams from your college economics textbook?

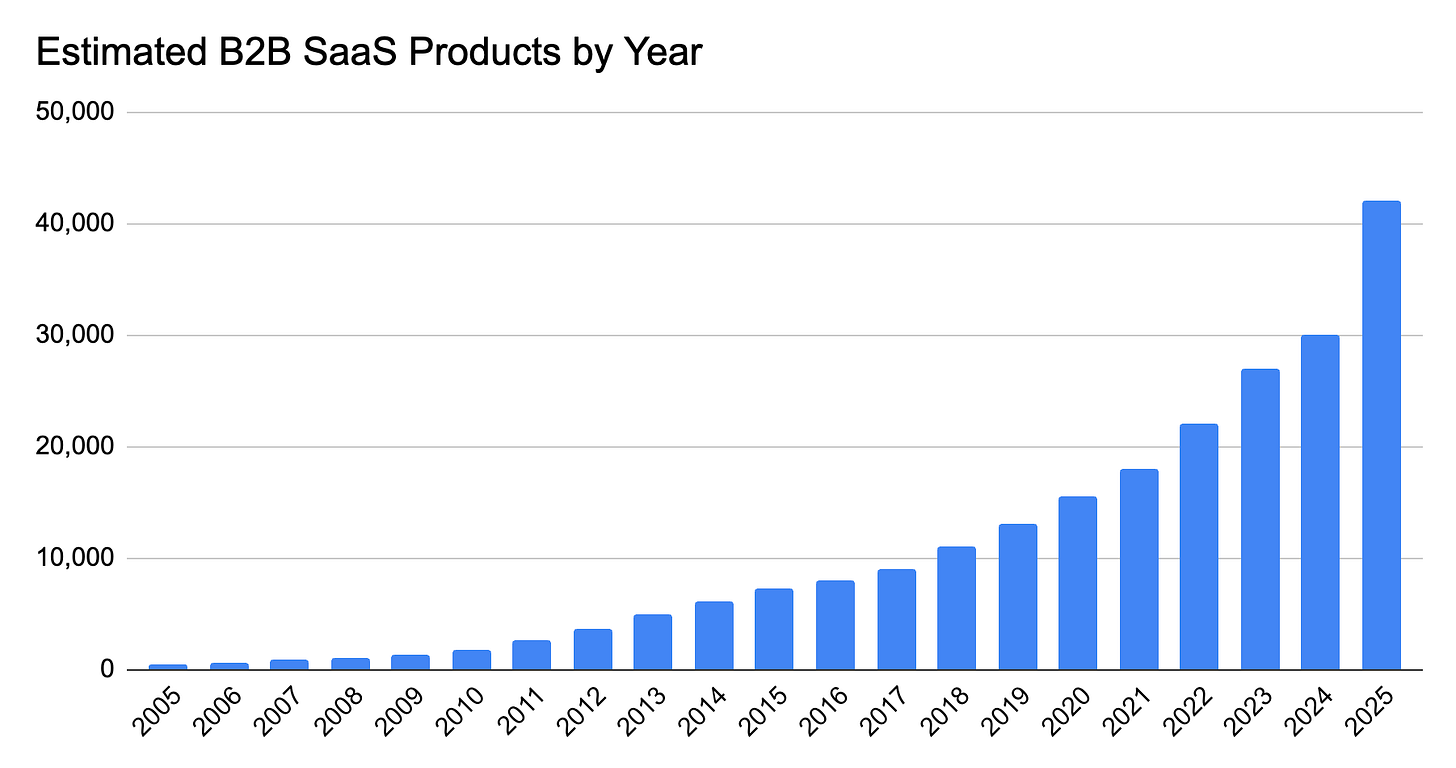

Turns out supply and demand have to meet somewhere. Who knew? Over the past few years, we’ve had an absolute explosion of B2B SaaS Products. I published the chart below in a previous article.

In short: there’s too damn much software chasing a limited supply of relatively easy-to-automate business problems. I’ll cite myself one more time:

Today, B2B problems and workflows are either already automated by an incumbent SaaS product or they fit into some remaining category that doesn’t have a SaaS solution yet. And why don’t they have a SaaS solution? Because they’ve been too freakin’ hard to build a successful SaaS product around. […] So what does this mean for SaaS sales in 2025? You’re either selling against an incumbent or suggesting you can solve a heretofore intractable problem.

This is a pretty depressing hypothesis if, like me, you sell B2B software. Do we just give up on bits and buy an HVAC business?

The solution is right there in the problem statement. We’ve either got to a) deliver disruptive3 approaches to “solved” problems or b) figure out how to solve previously intractable problems. Rolling out a new product (but with “a better UI”!) for a mostly-solved problem worked OK in 2019 but doesn’t cut it in 2025.

To me, that’s the promise of AI—it lets us attack problems differently. We can take a first-principles approach to solving a business problem that incorporates AI’s unique capabilities.4 Those solutions can look, act and deliver value differently from the solutions that came before.

But this was a GTM conference, so that’s not what we talked about. Instead we talked about how we could replicate the insane growth success of “AI native” companies by trying to copy their GTM motions.

Two problems:

Nobody knows what an AI native company is. Seriously, I’ve never seen anyone actually define it. As best I can tell it means a company that sells an AI thing and is growing absurdly fast.

Trying to copy the GTM motions of a high-flying AI startup for your company is a lot like hiring that quota-crushing Oracle rep to work at your Series A startup. It turns out context impacts performance.

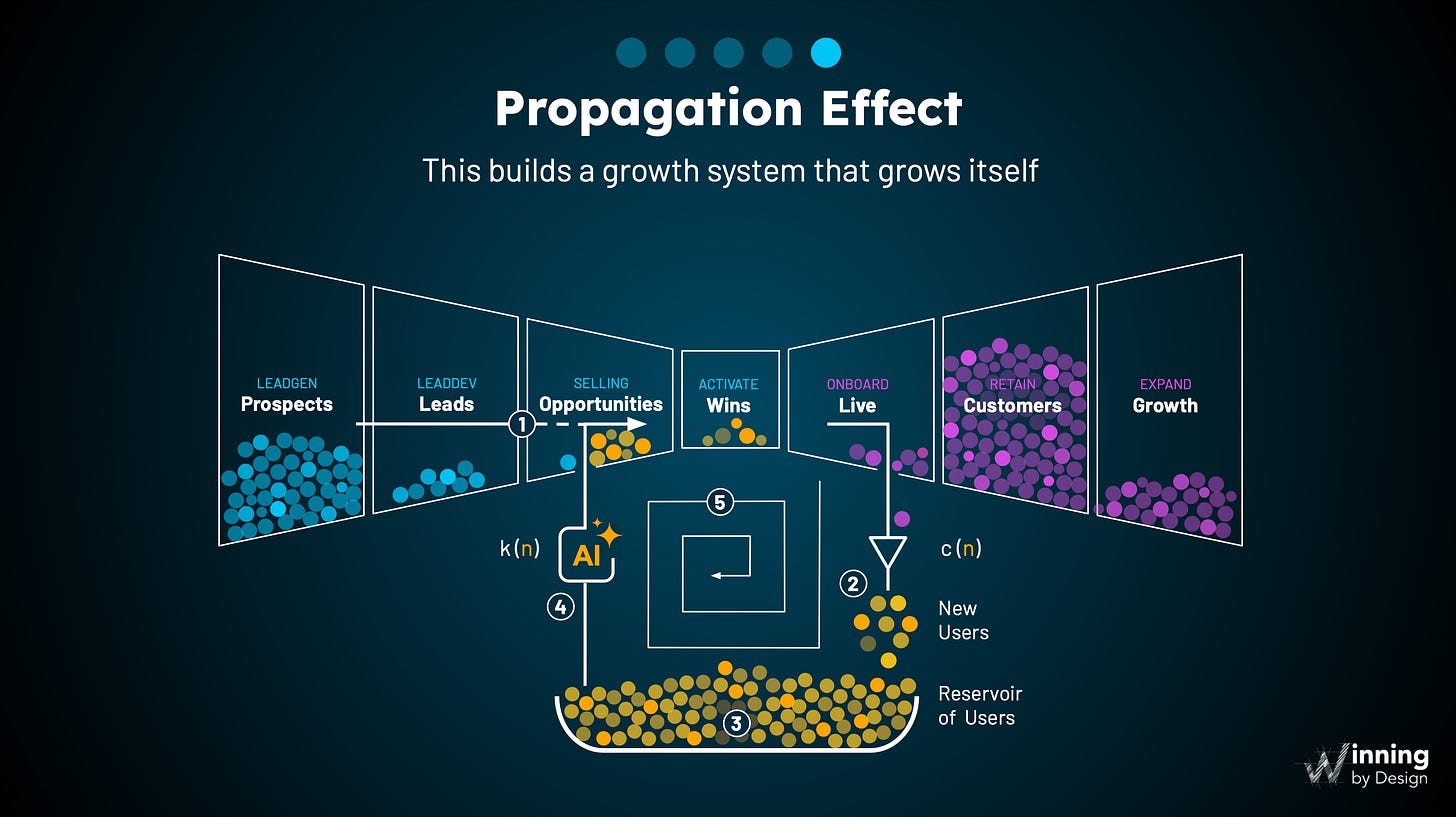

Here’s what I mean. Just look at this slide:

It looks lovely and very scientific—there’s k’s and c’s and n’s and parentheses. But honestly it’s just showing a PLG land-and-expand motion. The only AI things about this are the little sparkly AI box and the fact that most of today’s crazy-successful PLG companies sell AI products.

So if this is “just” PLG, then why are these companies so crazy successful?

Let’s start by asking a different question. Are they actually so crazy successful? It sure seems like it. Look at “vibe coding” startup Replit. First off, shoutout to these guys. They’ve been at this since 2016. By all accounts it seems like they toiled a long time in the valley of death before finding the accelerator. Respect.

Anyway, Replit went from $10M to $100M ARR in < 6 months. That was in June. In September they announced a $250M raise at a $3B valuation5 and $150M ARR.

First, let’s look closer at that $150M ARR number. Oh wait, that’s not “annual recurring revenue”… that’s “annualized” revenue. These companies aren’t paid-a-year-in-advance SaaS. They’re a combination monthly subscription fee + usage model. Those headline numbers are basically last month’s revenue x 12.

Second, their unit economics are pretty wack. I get it, startups lose money to grab market share, etc, etc. But this is in a whole other league. The Information reports Replit’s gross margins have ranged between -14% (yes, negative) and 36% this year. Other vibe coding startups like Loveable and Stackblitz were 35-40%. That’s a long way from the > 80% gross margins that made SaaS so attractive.

CJ Gustafson this week wrote a great newsletter article which sheds a different light on these headline numbers. These companies’ gross margins are so low because they’re basically reselling AI tokens from the LLM providers. That makes them look more like a marketplace or reseller than traditional SaaS. Per CJ:

If you do a switcheroo and swap ARR for GMV and Gross Margin for Take Rate, suddenly these “rocket ship” models look a lot more like super thin-spread ‘value-added’ marketplaces.

If we follow that line of reasoning, it would put Replit ($150M “GMV”, 36% “take rate”) at $54M in annualized revenue, or $4.5M MRR.6 That’s fantastic! But it’s not the same story as “$10M to $150M ARR in 9 months”.

Set that unit economics story aside for now. They’re still growing insanely fast. Clearly they’re doing something right?

Yes, they are. They’re operating a low-friction PLG model in a market where demand is off the charts. Going back to our economics charts above, demand is shifted way to the right. That should drive prices up, but it’s not. This is partly because there’s increasing supply but mostly it’s because these companies are all underpricing the market equilibrium (using VC money to make up the difference) in the hopes of acquiring market share.

There’s not much most of us can credibly copy from these companies aside from trying to reduce purchasing friction. If you were in the Netherlands in 1634, do you think you could have copied the GTM secrets of the “tulip native” companies to radically accelerate your herring business?

We’re not going to find the answers to our GTM problems in a ballroom listening to yet another panel about the “AI natives” (whatever that actually means). We’re going to find it by listening to customers, figuring out how to uniquely solve a problem that matters to them, and then finding more people like them. Over and over again.

My friend Paul Stansik recently put it well:

Want to know the secret to growing faster?

Sorry. There is no secret. There is no hack. There is no shortcut.

Growing faster takes basic, hard work. It’s about making sure more people who you wish would pay you money know who you are, get what you do, and feel like they can trust you. That’s it.

Let’s do more of that.

Apparently by 1985 the various inaugural galas needed bigger venues. Nancy did love to party.

I was there and Lord knows we’ve had our fair share of pipeline problems at various points.

I mean this in a Christensen’s Innovator’s Dilemma sense, not in a Shingy sense.

I’ve called this a Sewing Machine approach but let’s just say that hasn’t caught on.

One of their investors is Google’s AI Futures Fund. Replit pays Google Cloud lots of money for hosting and such. AI is filled with fun little circular investments like this.

Of course if you calculate that at a -14% take rate, their business actually gets worse with every customer they sign up.