Book Review: The Challenger Sale

What does this 14 year old classic mean in the age of AI?

A few weeks ago I reviewed The Goal. That went over well, so I figured I’d periodically review other GTM-related classics through the lens of sales in 2025.

I first bought The Challenger Sale by Matthew Dixon and Brent Adamson about 10 years ago when I was facing a sales slump at my previous startup. I listened to it across a few Muni trips to the office in SF. I found it interesting enough, but struggled to apply it to our situation at the time1.

I revisited it a couple of years ago when Gradient Works launched dynamic books and we needed an effective way to challenge the territory status quo for commercial sales teams.

This time, it was a perfect fit. We’ve heavily incorporated their approach to “commercial teaching” at Gradient Works. In particular, we’ve built our first call around the structure recommended in the “insight-led conversation” from Chapter 5. (More on that later.)

It’s not just us, the book remains extremely popular. After 14 years, it still ranks #7 in the Amazon Marketing and Sales bestseller list. The Challenger Sale is actually the oldest book in the top 10—sitting right above a self-published (yikes) audiobook entitled Turn ChatGPT into a Cash Machine (double yikes).

Unlike The Goal, this is a straightforward business book. Instead of a “business novel” narrative with a hero’s journey, it takes you through the usual consultants-turned-authors journey: credibility building => some research-driven insight => super important new thing => subtle hints that you should hire said consultant to help you do the super important new thing.

It also suffers from a moderate case of business book bloat. There are 25 pages of good ideas and information loosely packed into a 240-page book. Here’s a brief version of the good stuff:

Challenger reps stand out - Reps can be grouped into 5 profiles: problem solvers, lone wolves, relationship builders, hard workers and challengers. The Challenger profile stands out because nearly 40% of all top performers fit the Challenger profile—much more than the others.

Challengers teach, tailor and take control - Challengers understand a customer’s business, maintain a strong point of view, are willing to (respectfully) push, and are comfortable leaning into some (constructive) tension in the sales process. Specifically they can teach customers, tailor their message for different stakeholders and take control of the sales process.2

Sales orgs can turn their regular reps into challengers - Sales teams can equip reps with a set of insights and a structured process that allows them to teach customers something about their own business, offer a new perspective and catalyze them to take action. This is the titular Challenger Sale.

The rest of the book reiterates these things in various ways—with the exception of Chapters 7 and 8. Those are ostensibly about taking control of the sale and equipping font-line managers to support Challengers, respectively, but digress quite a bit from the main points. Chapter 8, in particular, reads like it came from another (pretty interesting!) book about sales managers that the authors wanted to write but which they didn’t have quite enough material for.

Let’s look at how this all holds up 14 years later.

How we use the Challenger Sale

Personally I find the “Teaching for Differentiation” chapters (4 and 5) the most relevant and concrete. These two chapters completely changed how we approach our prospect meetings at Gradient Works.

We knew we had to lead customers to the realization that static territories were actually an underlying cause of pipeline issues—especially for their commercial sales teams. We also knew that would be hard since territory design has hardly changed since 1919. It was going to take some serious education.

It turned out what we needed was “commercial teaching” which is laid out in Chapter 4. It has four key components:

Lead to your unique strengths - Make sure the “lesson” points to capabilities only your company can deliver. Otherwise, you’re just providing free consulting.

Challenge customers’ assumptions - Present something that “reframes” how a customer looks at their business. You don’t actually want the customer to respond with wholehearted agreement here—you want a “Huh, I’ve never though of it that way before”.

Catalyze action - Show the costs, risks or missed opportunities from the status quo and make it painful enough that the customer feels the need to act.

Scale across customers - Figure out how to segment customers by need/behavior and then equip reps with a small set of insights they can deliver to each segment (after a couple diagnostic questions).

Commercial teaching makes up the entire (relatively short) Chapter 4. After that, the authors move to Chapter 5 which presents a very concrete choreography for an actual commercial teaching pitch.

This is my favorite part of the book because it’s so clear and actionable. We actually took this choreography and built a storyboard for our first meeting (or two). You can see it below:

Our storyboard doesn’t perfectly follow the “insight-led conversation” structure (which may be a mistake since all this choreography builds on itself) but it’s very close.

We’ve found that we do best when we start with a small set of “orientation” questions (the authors refer to these as “diagnostic” questions in Chapter 4) which tie back to specific insights we use for our reframe. In our case, we find it important to understand the customer’s current territory design and how reliant they are on outbound for pipeline.

Done right, these diagnostic questions present an opportunity for some “mind reading” that builds credibility as opposed to feeling like a traditional discovery.

For example: “Most folks who sell e-commerce software right now have been dealing with customers who are nervous about tariffs. That’s slowed down inbound and put more pressure on outbound. How does that look for you all?” A question like this helps us learn the relative proportion of inbound and outbound in pipeline generation which impacts how we present the reframe.

We then move on to reframe the conversation around the surprising fact that static territory design is a root cause of pipeline challenges for commercial sales teams. We essentially combine Steps 2-4 in quick succession—pointing out how legacy territory models drag down pipeline and highlighting the frustrations that come with managing them.

Because we offer an unorthodox approach to the newly-realized territory problem, we find the biggest moment in our conversations is introducing the new way (Step 5). We do that with this slide and a well-practiced talk track:

This is where the prospect usually leans in and starts asking questions—some of them skeptical. We love it when this happens because we know we’ve got their attention. At this point we know we’ve shown them a new way of thinking which then drives a collaborative discussion about how this model could solve the problems we’ve highlighted in the prior reframe.

Overall, I give our version a B. We’ve got some work to do. I think we sometimes rush steps 3 or 4. We could stand to land the “rational drowning” harder with a few more concrete metrics. I also think should emphasize the emotional impact more than we do. After all, people don’t like building territories but they hate dealing with rep complaints about bad territories. There’s fertile emotional ground here.

While Gradient Works uses AI, we don’t necessarily lead with that as part of our core reframe. Perhaps that’s also a mistake, because a Challenger Sale is well-suited to the peculiarities of selling AI.

The Challenger Sale meets AI

Most of the examples in the book come from commodity sellers (e.g. Grainger) in a difficult sales environment (e.g. The Great Recession). At first glance, that seems irrelevant for anyone selling AI—an epochal technology—into a sizzling market. But, perhaps there’s more similarity than you might think.

The vast majority of insane growth stories in AI are foundation models, “prosumer” apps or both: ChatGPT, Claude, Replit, Lovable, Cursor, etc. The enterprise story is much less clear3. Sure there are lots of pilots, but 88% of them fail to reach production. Salesforce has bet its life on Agentforce and has been rewarded with a 30% decline in its stock price since January along with more attention from everyone’s favorite activist investor.

Beyond that, AI capabilities are rapidly commoditizing—from models to applications. Foundation models have no moat and it’s hard to say applications do either. Quick: tell me the major differentiators between Replit and Lovable or between ChatGPT and Claude. Only the hardest-core vibe coders could. And those companies are the AI natives who are Q2T3-ing. How much differentiation do you think your AI feature has when we’re in the fast fashion era of SaaS?

Honestly, nothing in the book made me think of AI more than this quote:

There’s no question that winning customer loyalty when you can’t differentiate yourself on product, brand, or price is difficult at best. […] As a head of sales at a global chemical company put it to us, “Sure, you and I may both sell five-gallon buckets of unbranded axle grease at the same price. But if I can sell my five-gallon bucket of unbranded axle grease better than you can sell your five-gallon bucket of unbranded axle grease—well, then I’m going to win. And the way I do that is by helping the customer think differently about their business.” And he’s right. After all, if he’s not, then there’s really nothing left other than price itself as the basis for differentiation. And in that case, why have a sales force at all? Put that unbranded axle grease online and sell it through your Web site. It’s a lot cheaper that way.

Dixon, Matthew; Adamson, Brent. The Challenger Sale (p. 54)

We’re already to the point that everyone has an AI feature. Selling AI may ultimately end up looking a lot like selling unbranded axle grease. You either find a way to do it PLG-style (prosumer) or you go all-in on a Challenger approach for the enterprise because a) that’s the only way to differentiate and b) they’re not going to get there on their own.

Don’t lead with, lead to. Remember, the real value of the interaction isn’t what you sell; it’s the insight you provide as part of the sales interaction itself.

Dixon, Matthew; Adamson, Brent. The Challenger Sale (p. 74)

I suspect this makes Challenger reps running a Challenger Sale perfect for the AI era. Enterprise customers are going to need a lot of leading to. In fact, commercial teaching for AI may go well beyond a slide deck and a talk track. You might even have to roll up your sleeves and do a big chunk of the work for them.4

A few other observations

Solution Selling is set up as the big bad the Challenger Sale must defeat. I came to sales a bit too late to fully understand how dominant that concept was in the early 2000s, but the authors blame it for many of the frustrations that are very much still alive—from protracted discoveries to risky leaps of faith.

Add in some broetry, and this passage about discovery could be a 2025 LinkedIn post:

This complicated and often rather protracted process [of discovery] requires a huge amount of customer involvement at each stage, placing two kinds of burden on the customer: The first is time, and the second is timing. Not only does this dance entail significant customer commitment across a wide range of different stakeholders, conference calls, and presentations, but from the customer’s point of view, most of this effort comes early, before they see any value. Really, it’s an act of faith on their part that they’re going to get anything in return for all of their trouble.

— Dixon, Matthew; Adamson, Brent. The Challenger Sale (p. 8)

They also blame solution selling for the gap between average and high performers:

In a transactional selling environment, the performance gap between average and star performers is 59 percent. […] However, in companies with solution selling models… they outperform by almost 200 percent.

— Dixon, Matthew; Adamson, Brent. The Challenger Sale (p. 11-12)

Obviously this disparity hasn’t gone away and there’s a good chance that AI will massively widen it.

Solution selling may be the main bad guy, but later we meet his henchman. Surprise! It’s the nicest rep you ever met. The “relationship builder” rep profile really takes a beating. I suppose it makes sense given that their research shows only 7% of high performers have that style.

While the Challenger is focused on customer value, the Relationship Builder is more concerned with customer convenience. The Challenger rep wins by maintaining a certain amount of constructive tension across the sale. The Relationship Builder, on the other hand, strives to resolve or defuse tension, not create it. […] They’re likable, but they’re not very effective.

— Dixon, Matthew; Adamson, Brent. The Challenger Sale (p. 26)

Lone Wolves get more respect. The authors even acknowledge (p. 91) that Lone Wolves actually have the highest probability of being top performers (18% of the sample but 25% of high performers). But as we all know, you can’t build a scalable org around people who simply refuse to do another rule.

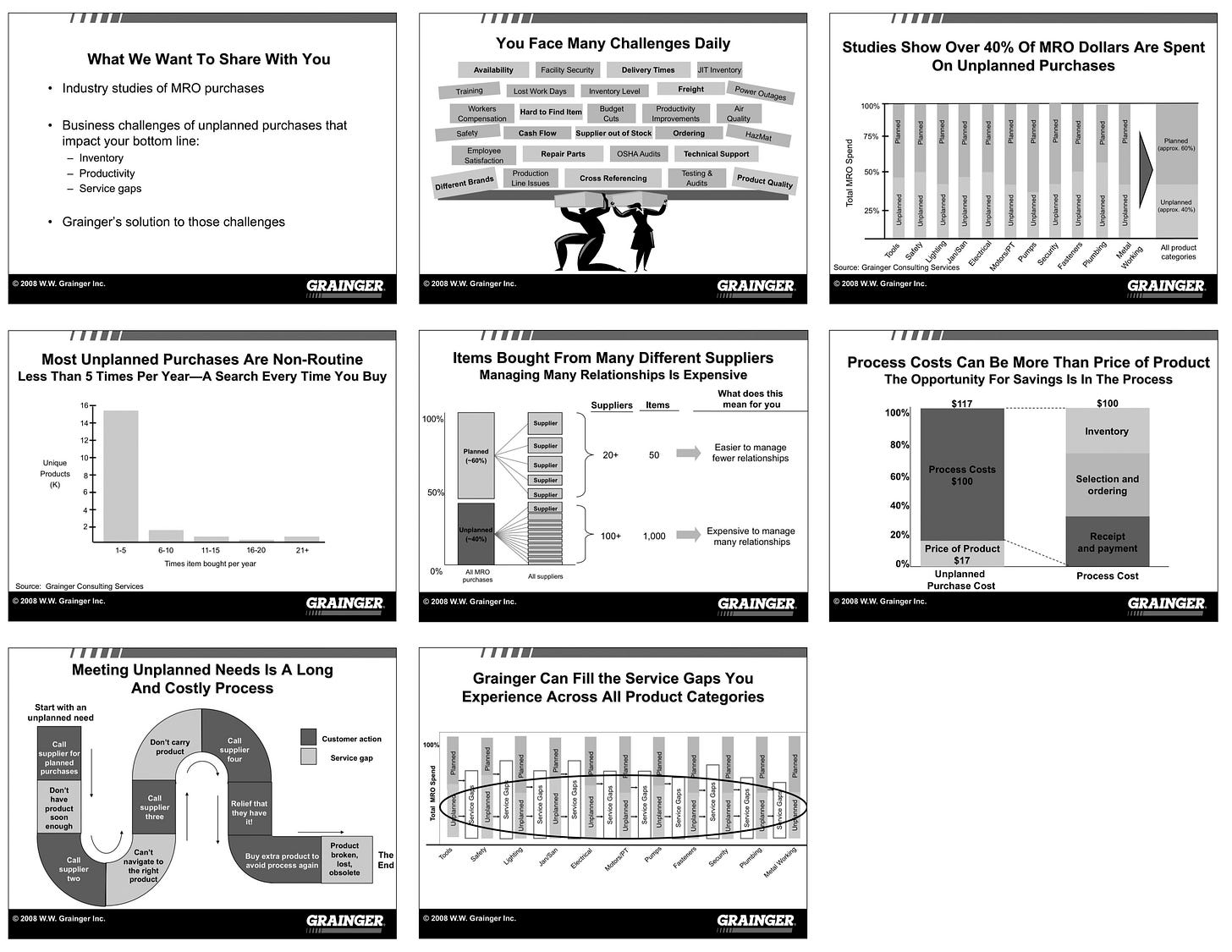

Next up, the Grainger deck! It anchors a big chunk of Chapter 5 and it’s a good example of the Challenger approach. But it’s also a perfectly preserved example of 2008-era PowerPoint style. Just look at this beauty:

Speaking of style, revisiting this book reminded me that some of the things people associate with AI-generated text—like em dashes and the “it’s not/it is” construct—were learned by AI models during training. Loyal readers of this newsletter know I love a good em dash, but Dixon and Adamson really do. I count 5 in the first 3 paragraphs alone.

Finally, it’s possible the most effective use of the challenger sale in history has been selling The Challenger Sale. The book itself follows the choreography of the “insight-led conversation” from Chapter 5 (Chapter 5 itself serves as part of Step 5). It’s basically a self-selling recursive loop.5

Wrapping up

The Challenger Sale has plenty of flaws. It has the usual business book baggage. It sometimes looks and sounds every bit of 14 years old. None of that makes the fundamental ideas any less salient to the current AI moment.

It’s never been more important to help customers see their business differently through the lens of AI and lead them to a different outcome. Enterprise customers will struggle mightily to see it on their own, much less take action. That’s going to take some serious teaching, tailoring and taking control.

In short, I’d put my money on the 10x rep being a Challenger.

We didn’t really need to do a lot of challenging back then. We were selling social media analytics to SMBs with a pretty transactional model. Also I was still early in my painful transition from software engineer to something resembling a GTM leader.

You lose your consultant license if you don’t use alliterative names.

Unless you make weapons.

Forward deployed engineers are just solutions engineers with a fancy name and the ability to treat them as R&D expenses instead of COGS. Fight me.

Somebody call Douglas Hofstadter.

Do you think that the best challenger sales come from a management consulting / PE / finance VC background ? In a way that they understand well how business operates.