Welcome to the Team! Now Fix Everything.

How to diagnose problems and make an impact in a new GTM role.

The first week of November is a special time in B2B SaaS. Since so many of these companies have fiscal years that end on January 31st, it marks the beginning of Q4.

The beginning of Q4 usually heralds one of two things for sales leaders: buckling down to hit the Q4 number or starting a new job entirely. Sure enough, last week I saw a big spike in those “starting a new position” LinkedIn posts. Anecdotally it feels like more folks than usual have decided to make the leap this year.

I certainly get the appeal of starting a new job in Q4. You get to influence planning for the next fiscal without getting blamed for this year’s results. That’s the good news.

The bad news is you need that extra quarter. Sales leader tenures are crazy short and 70% of these runs end involuntarily. You’re most likely replacing someone who was fired. It’s safe to say they weren’t fired because things were going too well. The board, the CEO and the rest of the team have brought you in with the expectation that you’re going to fix everything. And fix it fast.

With all that pressure, figuring out where to focus can be daunting, especially if you look at it as one big, thorny problem. You’ve got to break it down or you’ll find yourself stuck in analysis paralysis. The goal is to quickly find the bottleneck—the thing that’s holding back the entire system—and eliminate it.

Here’s my recommended process:

Model the funnel (or bowtie) to find your bottleneck

Diagnose the bottleneck

Quantitative diagnosis

Qualitative diagnosis

Make changes to address the bottleneck

Repeat

Let’s dig in.

Model the funnel

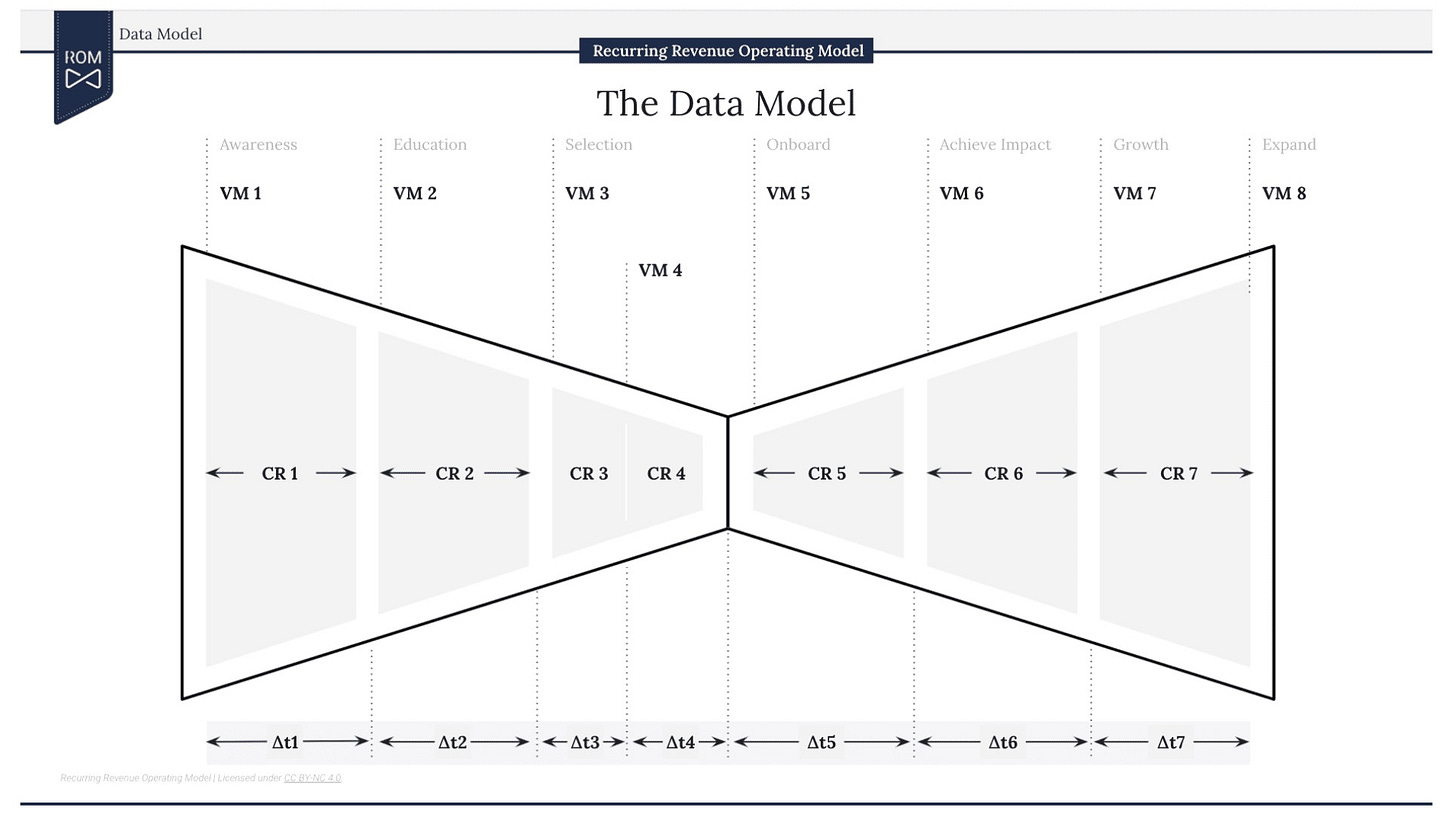

Start with high-level volume, conversion, and time metrics by working backward through the funnel (or the whole “bowtie” if you’re responsible for retention and expansion as well). If you’re not sure exactly what to measure, Winning By Design has a framework (see Chapter 5) that’s as good as any.

When you’re doing this, resist the urge to immediately diagnose and, whatever you do, don’t cherry-pick data. That will quickly lead you to the wrong conclusions.

For example, if you’re looking at lead-to-opportunity conversion rates, resist the urge to immediately dive in if the rate is low and don’t listen (yet) to someone who says “oh we don’t count those leads for reason X”. This is one reason why you might be wary of existing historical conversion rate data. It often comes with baked-in assumptions that mask problems.1

Make sure you know precisely what’s being counted for volume metrics and what’s going into the numerator and denominator for conversion rate metrics. For time-based metrics (e.g. sales cycle), make sure you know when the clock starts (e.g, opp creation? SQO? stage 4?). Generally speaking, use this effort to get at your “raw” metrics before you start adjusting for anything else.

There’s a roughly 0% chance you’ll have access to all the metrics you actually want at this stage. Some things won’t be tracked at all, some things won’t have the right timestamps, etc. That means there’s a roughly 100% chance this will be frustrating. The key is how you respond.

You can’t change the past, but you can impact the future. Work with your ops team2 to track the metrics you need going forward. The best time to solve this would have been a long time ago; the next best time is right now.

That said, remember that improving your data is an incremental process. Don’t succumb to the bad data binary and declare you can’t make progress until every problem is fixed. That’s a recipe for, well, making no progress at all. Move quickly, but deliberately: fix the easy things fast and fix the hard things thoughtfully.

Quantitative diagnosis

Once you’ve got your bowtie metrics, find your bottleneck. For example, if you have a 30% win rate but only convert 5% of leads to opportunities, increasing your win rate is unlikely to help. By the same token, increasing the volume of MQLs with more ads will just waste money.

Once you’ve found the bottleneck, now it’s time to dive deeper. This is when you should listen to how metrics been measured previously—just make sure to trust but verify. You should focus on trying to break down the bottleneck into root causes.

As an example, let’s say you find a low outbound contribution to pipeline. There are two likely culprits here: the accounts are bad or something about the way reps work the accounts isn’t right. At this point, it would be helpful to try to break down the accounts according to your ICP or segments (if you have that defined) AND also look at performance by rep. You’re likely to find that some segments convert better or some reps convert better.

Looking across those dimensions, consider key diagnostic metrics like incubation period, opportunity creation rate and account coverage.

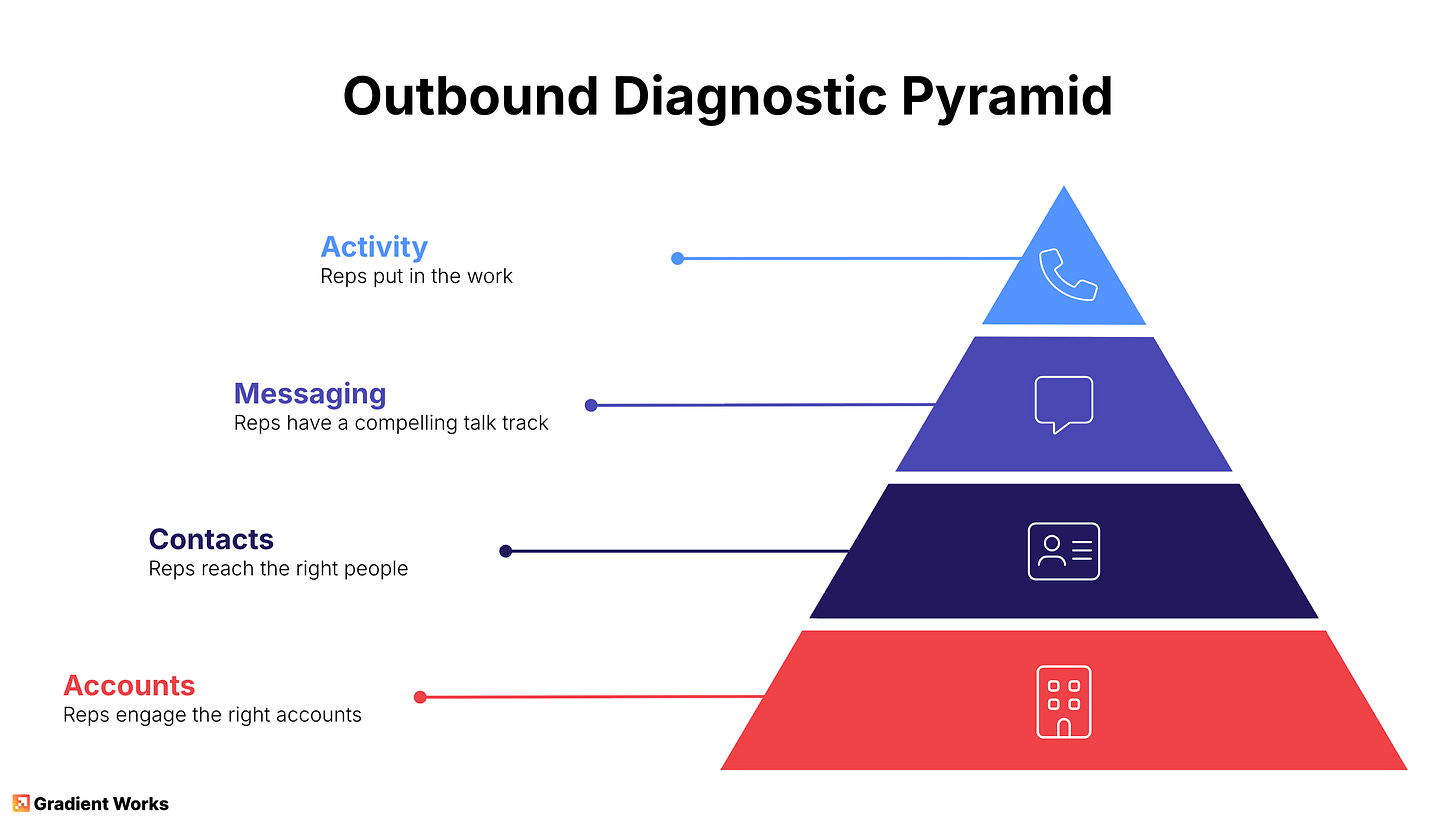

Then, break the problem down conceptually into a “diagnostic pyramid”. Think of outbound as a set of layers, each building on the next: activities at the top, that’s made effective by messaging, which is made effective by persona/contact and—at the base—are the accounts you’re working. The top 3 layers (activity, messaging, contacts) are fairly easy to change but they’re heavily dependent on the bottom layer (accounts). Don’t just assume more activity will get you where you need to go.

Finally, put the two together. If you find that you have a high opportunity creation rate, the problem may really be that you’re not covering enough accounts. If you find you have high account coverage, but are still struggling to create opportunities from outbound, the problem is likely lower down the pyramid.

This is just an example, but the pattern is the same no matter what:

Find the bottleneck in your bowtie

Investigate diagnostic metrics

Form a hypothesis about the root cause3

Quantitative analysis will uncover likely issues, but don’t start changing things just yet. Now it’s time to dig deep on the qualitative side.

Qualitative diagnosis

This is where you shut up, listen, observe and avoid the temptation to blindly start applying your playbook without adapting to your new context.

Talk to your colleagues on the leadership team. Ask why things have been done a certain way in the past. Ask them what they think needs to change.

Talk to your reps. Ask them what they think is working and not working—just don’t take it as gospel. Break out call recordings and go listen to real conversations. Listen to calls across reps, across customers and at different stages in the sales cycle. While I firmly believe you should actually listen with your own two ears, this is also a great place to apply AI. Paul Stansik has a handy framework for using AI to review calls.

Talk to your customers. If you’re primarily focused on new business, focus on understanding the happy customers since they’re the ones you want to replicate. For your happy customers, here are a few simple questions you can ask4:

What happened to make you feel certain buying our product was the right choice?

Now that you have our product, what’s the number one thing you’re able to do that you were’t able to do before?

Before you had our product, what were you using instead?

Listen to the good and the bad in all these conversations. If you’re taking over an existing team, something probably hasn’t been going well. But don’t let that make you assume your predecessor was an idiot. Assume positive intent all around and try to make sure you understand why a competent person would have made certain choices.

Use your judgment (that’s why you’re here!) but keep an open mind.

Make some change

Once you’ve done all of the above, then you’re ready to start making changes. Chances are good you’ll want to make quite a few changes, but recognize that forcing through 20 changes at once is likely to result in nothing changing.

Focus on 2-3 things that will have the most impact on your bottleneck and reinforce the hell out of them (especially with your front line managers). Once those are in place, move on to the next bottleneck and do it all over again.

Congrats on the new job! No pressure.

I once talked to a company that claimed 70% win rates. When I asked how they were doing that, they said “we only count qualified opportunities that get to Stage 3 and have an identified competitor”. That’s measuring something but it’s probably not going to be the most helpful to spot problems.

You really want a good ops partner for this. If you don’t have one, make them your first hire.

This is really about zooming into a part of your bowtie and finding the bottleneck driving the bottleneck. It’s a fractal.

Credit for these simple questions goes to Paul Stansik who may have partially stolen them from Forget the Funnel. It takes a village.