6 GTM Predictions for 2026

This AI thing could be big.

The last 12 months have been a wild ride for B2B GTM. AI’s inescapable. The economy, while definitely better than the prior two years, is weird and unpredictable. Nobody knows what to make of it all. Most GTM leaders I talk to seem to vacillate between anxiety and cautious optimism.

So, I figured why not build on that complete lack of certainty to make confident assertions about what’s going to happen next year?

That’s right, I’ve decided to go full pundit and give you my six 2026 predictions. I’ve tried to provide some rationale each one, but I’m sure some of these will look ridiculous in hindsight.

With that in mind, I give you my word that I’ll come back to these in 12 months and thoroughly roast myself for whatever I get wrong. I believe in both accountability and baking in some content for my future self.

Without further ado, here are my 2026 GTM predictions:

AI comes for RevOps

Clay’s wheel will spin slower

The US will have a (shallow) recession

At least one “AI native” fades away

We stop talking about * engineers

We’ll have a startup mass extinction event

As a bonus, I asked several knowledgeable GTM folks for their predictions. I’ve added thoughts from the likes of Sam Jacobs, CEO of Pavilion, and Kyle Norton, CRO of Owner.com, at the end.

Let’s do this.

1. AI comes for RevOps

Most of the conversation about GTM and AI has focused on replacing sellers (or at least the sellers doing low-complexity tasks). RevOps mostly seems like the beneficiary of an AI shift. After all, AI represents a new layer for GTM that shifts the balance of power from managing teams of human reps to orchestrating technical systems—a role RevOps was born to play.

The actual story is murkier. Earlier this summer, I wrote that there was a troubling lag in AI adoption by RevOps teams and that they might not have fully internalized how much of their existence involves being a natural language interface for the CRO.

Since then, AI has only gotten better at the things that CROs rely on RevOps for. Things like data management, analysis, reporting, documentation and system maintenance. All the major models are now mostly phenomenal at this stuff.

In 2026, we’ll see RevOps hiring slow as more of these tasks get turned over to AI.

2. Clay’s wheel will spin slower

Clay had an incredible 2025, hitting a $3.1B valuation and projecting $100M in revenue. Just about every GTM org I talk to is using Clay in some capacity, but there’s trouble brewing.

Former Netscape CEO Jim Barksdale famously said there are only two ways to make money: bundling and unbundling.

Traditionally, data enrichment has been about bundling—collect as much data as you can in one place, sell it at the highest margin possible and grab more share of wallet by creating a platform out of add-ons. ZoomInfo is the poster child for this kind of bundling in the GTM data space. It worked. They make $1.2B per year. People buy ZoomInfo, but nobody loves ZoomInfo. And each bad phone number erodes any sliver of goodwill that might exist.

Clay’s stroke of genius was two-fold: unbundle the whole thing and then empower people to piece it back together again.

Instead of paying ZoomInfo for access to all that data, you could make your own ZoomInfo by enriching just the data you needed from a host of different providers. You could even combine that with raw data scraped from the web and transformed with AI. Put it together however you like, and only pay for what you use.

The catch? All that unbundled capability had to be repackaged into something useful. So Clay championed the people willing to do that. They supported agencies and creators who could turn Clay’s complexity into services engagements. Eventually, the GTM Engineer was born.

It’s proven to be a powerful combination. The upshot, though, is that Clay has a high total cost of ownership. Not only do GTM teams foot the bill for credits, they also need specialized roles (either in-house or on retainer) to manage it.

Now, Clay is trying to build their own bundle. As Adam Schoenfeld put it, “the friendly people from Brooklyn now look hyper aggressive.” They’re not only competing with ZoomInfo, but nearly every other part of the GTM stack. And, the more they try to simplify their core product to expand their market, the more they risk alienating the GTM Engineer role they’ve built themselves around.

Don’t get me wrong, these are good problems to have. They’re still going to grow, but in 2026 that growth will slow down markedly.

3. The US will have a (shallow) recession

There’s reasonable evidence that the US economy wouldn’t be doing so hot if it weren’t being propped up by the AI boom. We’ve got tariffs, combined with sticky inflation and a cloudy unemployment picture.

I’ll make a sub-prediction here: the AI bubble won’t burst and take us all with it, but it will deflate a bit. There are some weak links that are using a lot of debt to do things like fund data centers based on demand that may not emerge right on schedule. Some of those won’t make it through 2026.

Ultimately, there will be enough AI turmoil to spook investors and dampen the hype, which will eliminate the post that’s currently propping up the economy.

4. At least one of the “AI natives” fades.

One or more of the $100M-ARR-in-the-blink-of-an-eye AI natives will hit a churn wall and sees their growth suddenly hit an asymptote. Cassie Young termed this the Gross Retention Apocalypse and I’m 100% on board.

We won’t see a spectacular bust because churn kills slowly (unlike debt). We’ll see some early sales—followed by fire sales—when this starts to happen.

5. We stop talking about * engineers.

In 2025, everyone wanted to be an engineer. In particular, we had the rise of GTM Engineers and Forward Deployed Engineers. I believe these aren’t durable roles and the hype will die down in 2026.

When new technology shows up, nobody knows how it’s supposed to work. It’s complicated and finicky so you need specialists to go figure it out. AI has produced myriad new, complicated and finicky things. Therefore, we need specialists. Often those specialists are kinda making it up as they go along (after all no one actually knows what they’re doing when something’s brand new) so they need a patina of credibility. “Engineer” sounds cool, credible and technical, so here we are.

As technology matures, things get simpler and the need for specialists goes away. Way back in the year 2000, I did a summer internship at a dot com after my freshman year in college1. We had big teams of people with computer science degrees building…. e-commerce websites. The sites we built were vastly inferior to the one your crafty cousin sets up in an evening on Shopify when she finally decides to sell her artisanal soaps. But in 2000, selling some stuff on the internet required bespoke expertise, cost $1M+ and took a year (if it could even be done at all).

Every technology has a maturity curve. AI’s should be faster than any other technology—part of the promise of AI is that the AI itself can do most of the hard technical work for you—but it still very much exists.

Before all the GTM Engineers descend on this newsletter with pitchforks and Clay tables, let me just say: more parts of GTM are now able to be orchestrated with technology than ever before2. There’s meaningful work there, but it’s inevitably going to get simpler, less technical and more accessible to more people.

In short, all these engineers titles are a symptom of things being too damn complicated right now. That will start to abate in 2026, taking the engineer titles with it.

6. We’ll have a startup mass extinction event

I recently finished Otherlands, a book that genuinely has nothing to do with B2B sales3. Instead, it’s a reverse-chronology tour of extinct life on Earth that opens with Alaskan horses 20,000 years ago and ends with the emergence of multi-cellular life 550 million years ago.

Naturally, it includes well-known events like the meteorite that killed the dinosaurs and the Cambrian explosion4. One thing I hadn’t heard about, though, is an extinction event called “The Great Dying”5 that happened ~250M years ago in which 95% of all species on earth went extinct thanks to a massive volcano in Siberia.

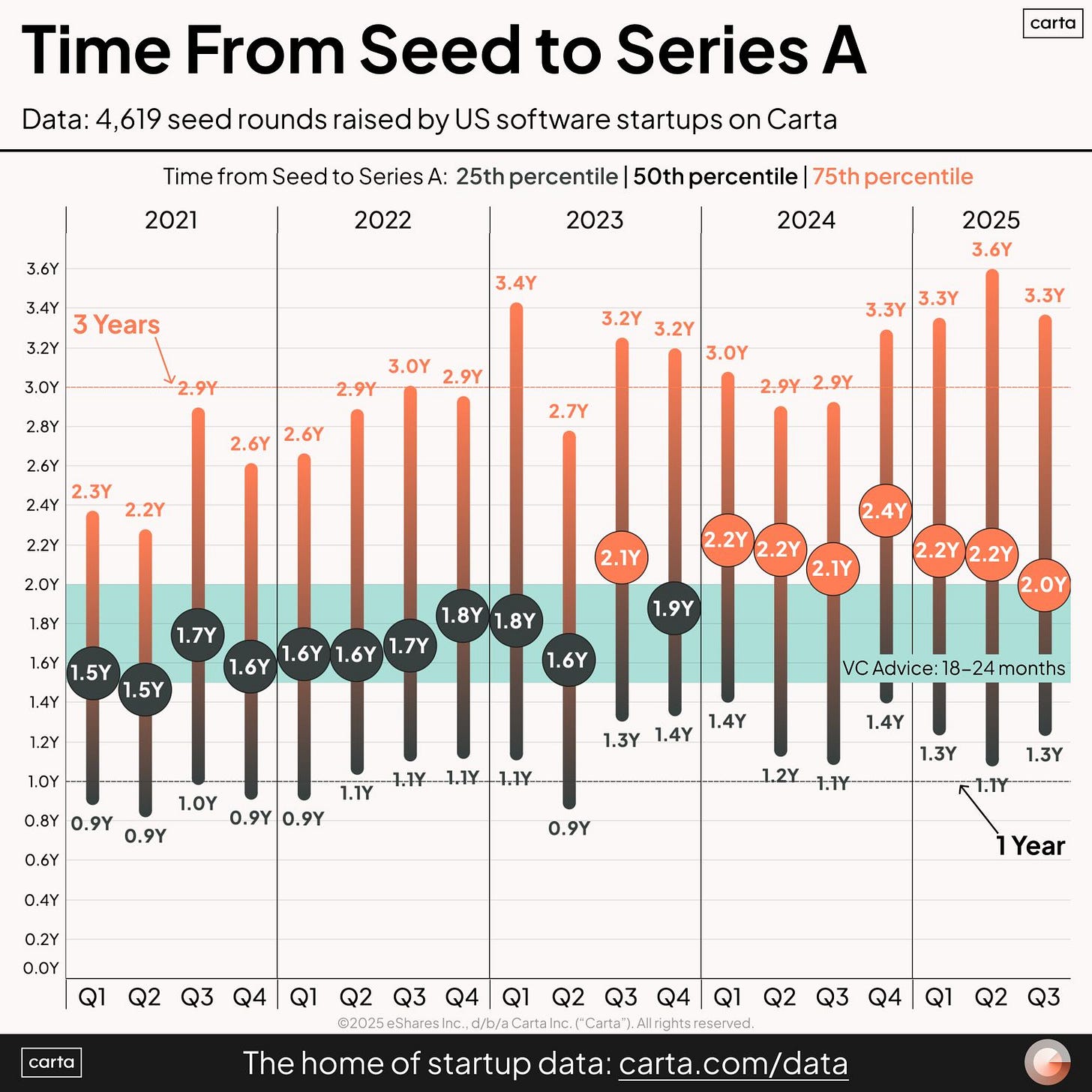

I think 2026 will see a mass extinction event for startups—not 95%, but a large number. There are a lot of startups that are barely hanging on from rounds raised during the Cambrian explosion of funding that ended in 2022. Just take a look at this Carta data:

And these are the ones that have gotten to a next round. There are still quite a lot of startups (at all rounds) that have stretched about as far as they can stretch. Carta also reports that bridge round funding ticked up again in 2025. At some point, there really is an end to the runway and we’ve got to be approaching it.

So there you have it. Those are my six predictions. We’ll check back in a year. Meanwhile, let’s see what some other folks had to say.

Crowdsourced Predictions

Most of these came from responses to a LinkedIn post. They’ve been lightly edited for clarity.

Let’s start with a spicy one:

OpenAI will go through a restructuring and Sam Altman will not be the CEO in 12 months.

Sam Jacobs - Founder & CEO, Pavilion

We’re already seeing this quietly but I think 2026 will be the Great GTM Bifurcation where companies that were early and aggressive adopters of AI in GTM will start breaking away. The leverage of AI is so great and I think many companies will start hitting a maturity level where the compound returns become pretty massive.

We’re already feeling this in our business and yet I feel like we’re just scratching the surface. We’ve gone from 0 dedicated GTM AI headcount 6 months to 2 today and more soon, which is greatly accelerating our progress. Our first productive AI use case went live in 2022 (I can’t believe that’s 3 years ago 😅) and yet I only feel like we hit our stride in the last few quarters.Kyle Norton - CRO at Owner.com and host of The Revenue Leadership Podcast

Employee morale will likely take a hit across U.S. businesses as AI continues to replace roles. The companies that succeed won’t just adopt AI, but they’ll use it to empower and enhance their people. Those that position AI as a tool for growth rather than a threat will see a boost in morale. By the end of 2026, employee engagement will be a bigger priority than it’s been since the lockdown. I guess there is a GTM angle: keep this in mind when crafting your messaging or pitching—how you frame AI’s role in enabling people, not replacing them, will resonate deeply with prospects and customers.

Ryan Simmons - VP, Global SaaS Sales at Terryberry

Marketers will feel more pressure from CEOs and CROs to “show up” in LLM responses as LLM adoption moves into the mainstream with consumers.

1) Lack of visibility in LLM responses means lack of “frame-making” influence at the time people are learning about things.

2) Lack of visibility in LLM responses will undermine confidence in a solution/service/product/idea.David Kirkdorffer - Consultant

It’s very early, but enterprise GTM will increasingly be abstracted by agents. Business arrangements between two ISVs with agentic transactions will require new models. These transactions will happen at the machine level, requiring machine level SLAs, hallucination risk absorption, and revenue share.

[Ed note: I asked Dustin about the possibility of “hallucination insurance”]

I guess it’s almost inevitable. Transferring risk for a fee is as old as The Dutch East India Company, and here, it’s a real risk that costs money.

Dustin R. Thompson - Head of US Partnerships at Promon

Many firms will cut back on customer success & support headcount in favor of AI solutions right as a massive wave of churn hits. There will be a scramble for qualified CS candidates by the end of the year as 2027 annual plans are baked with hope for improving GRR.

Ryan Burke - VP of Sales at Zilla Security

And finally:

This AI thing seems like it’s gonna be big. Like and subscribe for more game-changing insights.

Paul Stansik - Partner at ParkerGale Capital and author of Hello Operator (which you actually should subscribe to)

You know, I think Paul’s probably right about this one.

Fun fact, this dot com got delisted from the Nasdaq three months after I finished my internship.

Not unlike corn production in the 1940s.

But I won’t let that stop me!

Honestly, the author is kind of dismissive of the whole Cambrian explosion deal, calling it “an illusion, based on a characteristic of Cambrian animals – their hard parts.” I guess we just don’t have a good record of all the weird squishy guys that came before.

Pretty metal name if you ask me. \m/

"The Great Dying" just hits my funny bone

Sam Altman is unraveling in real time right now - def on board with your prediction and doodle.

I was JUST scrolling through one of those partnership discount sites for b2b tools - and omg so many SaaS tools are RELICS now. Remember UNBOUNCE and Instapage??

I would add that AI for collaboration between multiple teams should also be tackled next year.

Every individual has access to any signal you want, buying triggers, you can research like never before accounts in your ICP at scale.

But do we have the right processes to use it on sales cycles where multiple people are involved on each side? (I am quite bullish at what you are building at Gradient Works, as I feel being able to plan dynamically is a key answer to this.)

Engineers might fade away from tools like Clay, but they will be quite needed in RevOps for orchestration.